Campaigns

/campaigns/legacy/

/campaigns/imula50/

/campaigns/imula50/

/campaigns/imula50/

/campaigns/insurelitroadshow2024/

/campaigns/imula50/

/campaigns/did-you-know-series/

/campaigns/imula50/

/campaigns/insurelit/

/campaigns/imula50/

/campaigns/our-client-stories/overview/

/campaigns/imula50/

/campaigns/terms-and-conditions-guidelines/

/campaigns/imula50/

/campaigns/choose-your-legacy-campaign/choose-your-legacy/

/campaigns/imula50/

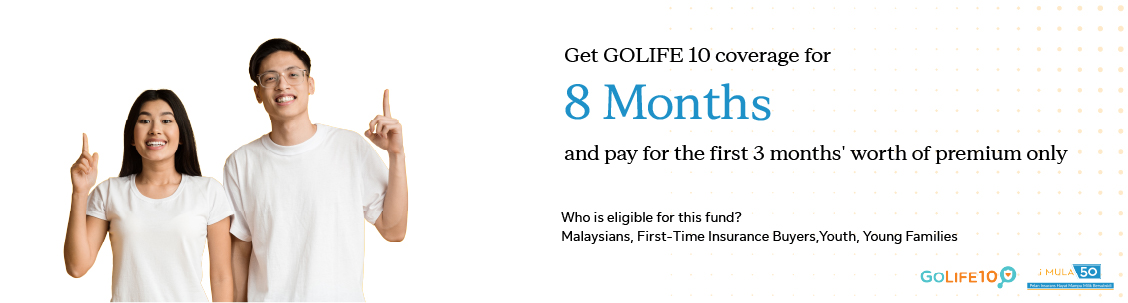

once the RM5 million fund is fully utilised.

What does GoLife10 cover ?

|

RM 38,000 |

RM 76,000 |

|---|---|

|

Coverage: Death / Total and permanent |

Coverage: Death / Total and permanent disability |

* Specified infectious diseases being:

Dengue Fever, Chikungunya Fever, Malaria, Japanese Encephalitis, Avian Influenza and Zika Virus only.

You can enrol for GoLife 10 plan

via GoPayz account with these simple steps:

Download the GoPayz app from Apple App Store or Google Play

Select the “Life Insurance” tab under Financial Services tab

Select GoLife 10 and fill in the details

Key in "imula50" under Shop Promo Code column and proceed to click the confirm button at the check-out page

For more information, please refer to the iMula50 GoLife 10 Campaign.

Frequently Asked Questions About the i-Mula50 programme

- Malaysian citizens between the age 18-49 and

- in good health condition, not on any medication and not suffering from any form of disability or serious illness and have no history of admission to hospital in the past 2 years.

- selecting the “Life Insurance” tab under Financial Services tab;

- selecting GoLife 10;

- keying in “IMULA50” under Shop Promo Code column;

- making an initial payment of RM10 for the monthly premium at the checkout page to participate in this Programme; and

- continuing to make monthly contribution of at least RM10 for the next two (2) consecutive months.