About Us

/about-us/who-are-we/

/about-us/sustainability/

/about-us/leadership/

/about-us/sustainability/

/about-us/awards-and-recognition/

/about-us/sustainability/

/about-us/newsroom/

/about-us/sustainability/

/about-us/sustainability/

/about-us/sustainability/

/about-us/anti-bribery-and-anti-corruption-guidelines/

/about-us/sustainability/

/about-us/whistleblowing-guideline/

/about-us/sustainability/

Value-Based Intermediation for Takaful (VBIT)

Our Corporate Value Intent (CVI) serves as a guiding principles for our organization’s culture, including initiatives on our direction to a future takaful industry landscape.

In line with VBIT Underpinning Thrusts and our core values – we strive to deliver the intended outcomes of Maqasid Shariah in our product offerings and services, going beyond the minimum Shariah requirements.

Financial Security

SLMT aspires to increase the lifetime financial security of our Clients, employees and communities through innovative takaful products and services.

Sustainable Investing

SLMT aspires to deliver sustainable returns for Clients by investing into shariah-compliant sustainable assets1 and drive the transition to a low-carbon, inclusive economy.

Trusted and Responsible Business

SLMT is committed to uphold the principles of Maqasid Shariah and become an operationally ethical Takaful Operator, as well as being environmentally and socially responsible to our Clients and employees.

Healthier Lives

SLMT aspires to improve health and wellness outcomes of society by improving access to innovative health solutions and facilitating positive actions.

1 Renewable Energy, Green Buildings, Green Sustainable and Responsible Investment Sukuk as well as sukuks based on internal ESG criteria or methodology

* Disclaimer: Sun Life Malaysia Takaful (SLMT)

An Introduction to VBIT

VBIT is a Takaful industry aspiration for adoption of best practices and services providing SUSTAINABLE impact benefitting people, business and society whilst realizing the intended outcomes of Shariah (MAQASID SHARIAH).

The Takaful Industry must reconsider how it is perceived, and VBIT will provide new opportunities for stakeholders to REIMAGINE Takaful.

Although VBIT shares resemblances with concepts such as Environmental, Social and Corporate Governance (ESG), and Sustainable and Responsible Impact Financing (SRI), the main difference is the central position of Shariah in the determination of its best practices, conducts and offerings.

5 VBIT underpinning thrust

Financial Resilience

Community Empowerment

Good Self Governance

Best Conduct

Capacity Building

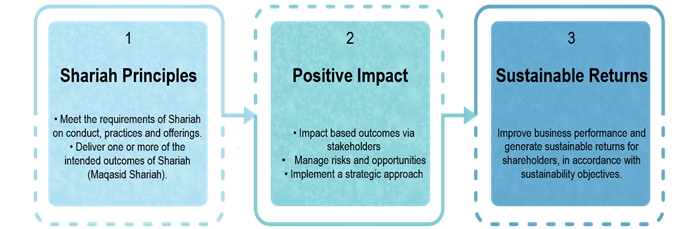

Implementing VBIT

SLMT shall consider these three key aspects when we implement our VBIT initiatives :

Value Creation for Stakeholders

- Receive Better Quality of Offerings (Products & Services) - Value-based products and offerings can cover the broad range of demands for Takaful among members of society. This can elevate and empower the community to attain long-term financial resilience, especially in times of emergencies and misfortune. Financial resilience can result in a substantial increase in productivity and quality of life.

- Fair and Better Transparency - The extensive adoption of VBIT can foster good and ethical business conduct, which will build strong confidence in TOs among customers and society at large. Better transparency also improves Takaful literacy in society and creates better understanding of the role and processes involved in Takaful operations.

- Better Awareness and Preventing Negative Outputs - Through impact-based assessments, customers become more aware of the impacts of the business dealings they are involved in. For example, TOs can prevent further damage to the environment by filtering environmentally damaging business activities and assisting customers currently engaged in such activities to become environmentally sustainable.

- Better Alignment of Business Focus with the National Agenda - Value-based products and offerings can cover the broad range of demands for Takaful among members of society. This can elevate and empower the community to attain long-term financial resilience, especially in times of emergencies and misfortune. Financial resilience can result in a substantial increase in productivity and quality of life.

- Greater Integration and Effective Collaboration - The extensive adoption of VBIT can foster good and ethical business conduct, which will build strong confidence in Takaful Operators (TO) among customers and society at large. Better transparency also improves Takaful literacy in society and creates better understanding of the role and processes involved in Takaful operations.

- Financial Stability - Through impact-based assessments, customers become more aware of the impacts of the business dealings they are involved in. For example, TOs can prevent further damage to the environment by filtering environmentally damaging business activities and assisting customers currently engaged in such activities to become environmentally sustainable.

Enhance Operational Efficiency - Optimising operational efficiency by inculcating an internal value-based culture, responsible procurement and the development of businesses/ individuals offering good value to stakeholders.

Unlock Business Opportunities inthe Underserved & Unserved Markets - Upholding an impact-driven mindset that inspires the exploration of new market segments to increase the rate of market penetration.

Increase Penetration - Focusing on new target market segments that can increase the rate of market penetration and assist customers.

Increase Competitiveness - VBIT has the potential to enhance TOs to actively evolve and develop their value propositions, skills and creativity in order to maintain competitiveness in the market.

Effective Ecosystem - A strong Takaful ecosystem can reinforce expertise in risk management and supply chain processes. This creates opportunities for growth and business success in the Takaful industry, while offering solutions in overcoming societal problems.

Enhance Corporate Image - Over time, TOs can establish strong corporate brands in the local and global markets, while gaining the ability to attract talent with a better corporate image by offering substantial value propositions in their business.

Our contributions

- Ensuring affordability: Pay-as-you-go affordable low monthly contributions

- Ease of access: Distributed via GoPayz (U Mobile, E-Wallet plan).

- Client mobile application enhancement: Allows SLMT clients to perform Conditional Hibah digitally via the client app, SunAccess

- Improves TAT and empower clients through digital innovation that enable them to perform online nomination.

- Waqf allows a facility to be developed benefiting all parties (including non-Muslims).

- Zakat allows the less fortunate to fulfil their basic needs (food, clothing, education, medicine).

- Hibah allows beneficiaries to receive direct benefits to survive in the event of death.

- Allows charitable activities from waqf contribution.

- Humanitarian aid shows concern for the plight of others for various reasons.

More About Malaysian Takaful Association’s (MTA) VBIT

More About Sun Life Group Sustainability